How do I update my VAT registration status and VAT number? Artfinder Seller Support

Jharkhand Value Added Tax (Amendment) Act, 2016. Share This. Jharkhand Value Added Tax (Amendment) Act, 2016. Form of Application for License to Drive a Motor Vehicle.. Government of India. The content linked through NPI is owned and maintained by the respective Ministries/Departments. Last reviewed and updated on 07 Oct, 2021.

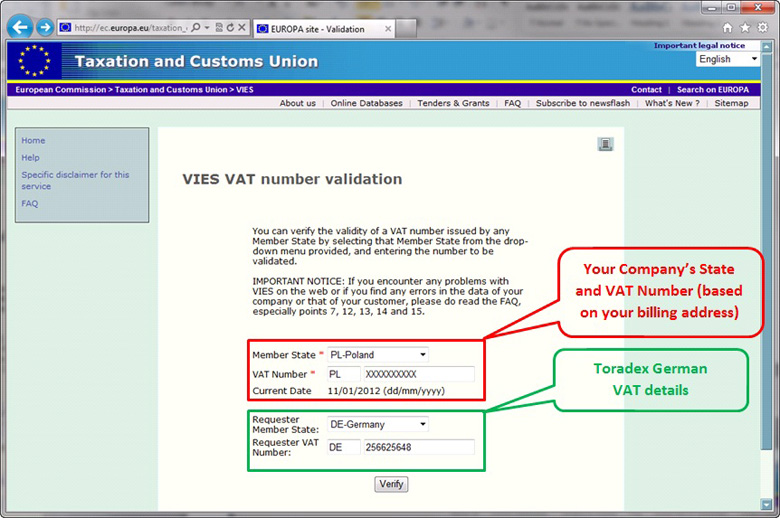

Toradex How to validate the EUVAT number?

When registered for VAT, the manufacturer or trader is allotted a unique 11 digit number which will serve as the VAT Number / TIN Number / CST Number for the business.VAT / TIN / CST utilize the same unique 11 digit number. Therefore, VAT / TIN / CST are the same and obtaining VAT Registration from the State authorities will suffice as the TIN.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

The value added tax (VAT) is a type of tax that is charged to all goods and services traded on the Indian market. In July 2017, India introduced a new legislation, through which the local authorities modified the manner in which natural persons and legal entities are imposed with this tax.

Verification of Russian VAT identification numbers VATupdate

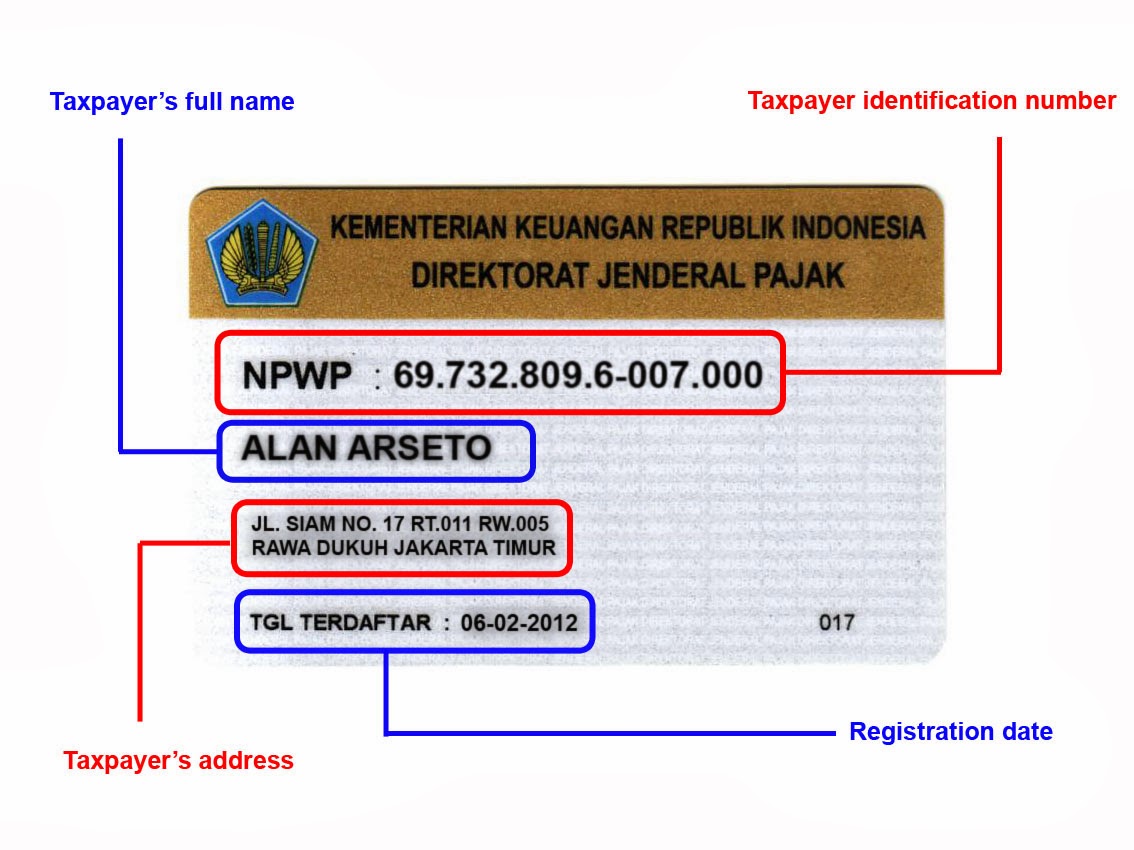

This document list downs the local name of the VAT numbers and its formats. 9 characters. The first character is always 'U'. le numéro d'identification ą la taxe sur la valeur ajoutée BTW - identificatienummer (BTW, TVA, NWSt) 10 characters. Prefix with zero '0' if the customer provides a 9 digit VAT number.

Validate Vat Registration and Tax Number 1 for EU countries SAP Blogs

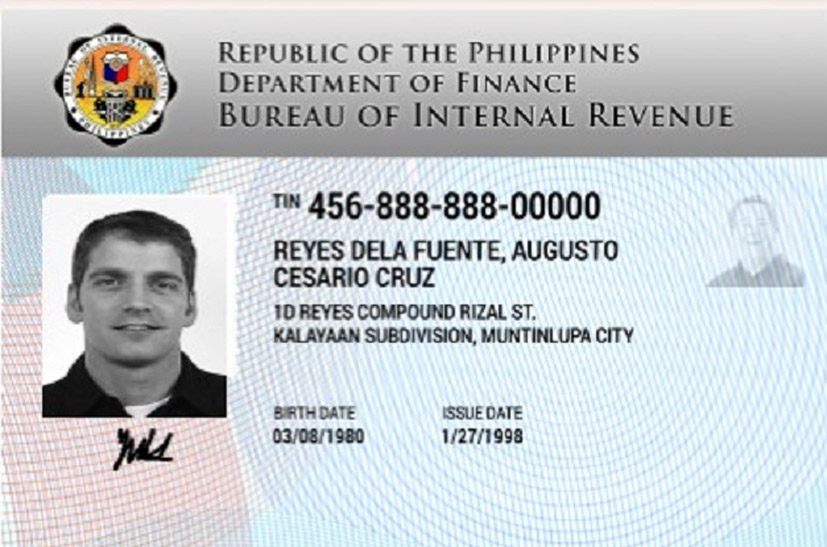

The procedure for applying for a Tax Identification Number India is outlined below -. Go to the site of your state government and register for the VAT portal. After completing, log in to the online portal. Fill out the TIN registration form on the portal with the essential information. Attach all supporting documentation.

India VAT Number Checker Android Apps on Google Play

How to know the TIN application status? FAQs What is TIN number in India? The Taxpayer Identification Number, commonly referred to as TIN, serves as a crucial and distinct identification code for every business establishment that is officially registered under the Value Added Tax (VAT) system.

VAT ID All information about the VAT identification number Blister Magazine

Information on TIN/VAT. Taxpayer Identification Number (TIN) is the complete version of what was previously known as the VAT (Value Added Tax) / CST (Central Sales Tax) or Sales Tax Number.. The terms Director Identification Number (DIN) and Designated Partner Identification Number (DPIN) are interchangeable. In India, a DPIN is necessary to.

How VAT works and is collected (valueadded tax) Novashare

VAT Number Formats.. (VATIN) as TIN (Tax Identification Number), TRG (Tax Registration Number), or GSTIN (Goods and Service Tax Identification Number). The format may be different depending on the country. It usually begins with a country identification code, followed by a series of digits and sometimes letters.. India: 1234567890123Z1.

1.7.2.4 IDNUMBER vs. VATnumber General topics Forums

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

Quick Fix 4 Administration of the VAT identification number Baker Tilly

VAT registration or TIN number is a mandatory and important process for all traders or businesses who are actively involved with manufacturing or even in the sale of goods and products. VAT is quite similar to Sales Tax but it's quite different from sales tax considering that it is collected once at the time of purchasing.

Adding a VAT ID to your account contacts

The Value Added Tax Identification Number (VATIN) is a unique identifier used by many countries to identify entities for Value Added Tax purposes. These identification numbers are mostly numeric digits beginning with a 2-letter country code. VAT-registered businesses are required to collect VAT from their customers and return it to the.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

Introduction (Value Added Tax) Additional instructions dated 9th June 2009 on VAT Compensation. VAT Compensation Guidelines dated 19th July 2005. Description: Department of Revenue functions under the overall direction and control of the Secretary (Revenue). It exercises control in respect of matters relating to all the Direct and Indirect.

Applying For A Digitized Taxpayer's Identification Number (TIN) ID

To make an application for Tax Identification Number, follow the steps mentioned below. Step 1 - Sign in to the VAT portal of your state with a unique login ID. Step 2 - Fill in the application form on the portal with the necessary details and upload the documents. Step 3 - This application will be verified by the commercial tax department of a.

What is a VAT identification number? Virtual office

TIN, or Taxpayer Identification Number, is a unique identification number required for every business enterprise registered under VAT. It is typically contains 11 characters out of which the last two depict the state of the applicant and is provided by the IT department to all the business entities willing to register under VAT or CST.

Tax Identification Number Malaysia FIRS issues deadline for taxpayers to obtain Tax

Value Added Tax or VAT is nothing but a levy that was established by the Indian Government (the Central Government) in the early 2000s. The VAT and service tax have now been replaced by the uniform tax regime the Goods and Services Tax (). Value Added Tax is valid tax levied by the Central Government on the value added to a product or services before reaching to the final customers.

How To Find VAT Number In Saudi Arabia

A VAT registration number is alphanumeric and consists of up to 15 characters. The first two letters indicate the respective member state, for example DE for Germany. When entering your VAT number, it must include the two letters that identify your EU member state (e.g. DK for Denmark, EL for Greece, and GB for the United Kingdom).